Traditional IRAs vs. Roth IRAs | Taxes and Building Wealth

The year is wrapping up and a goal for a lot of Americans means building wealth for a stable future. For many this means re-working the family budget, looking for money-saving discounts, and learning new ways to keep more money in the bank. One great way to keep money in your family’s pocket is to keep your taxes as low as possible. This article will focus on how you can use Traditional IRAs and Roth IRAs to save on your taxes and save for your retirement.

What are Traditional IRAs and Roth IRAs?

First, let’s review what IRAs are and how they can help you. IRA stands for Individual Retirement Account and can be thought of as an investment for your future. The IRS gives you tax savings for saving for your retirement. You are able to access these funds once you reach a certain age, which is 60 as of 2022.

The two main IRAs are often Traditional IRAs and Roth IRAs. The IRS will only let you contribute a certain amount to these accounts. If you are under the age of 50, you are only able to contribute $6,000 a year to save on your taxes. If you are over 50, you are able to contribute $7,000. In 2023 the IRS will raise those limits by $500 for all age groups.

How Traditional IRAs and Roth IRAs Can Affect Your Taxes

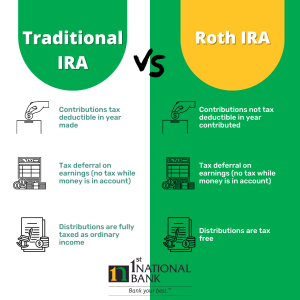

Traditional IRAs provide tax savings the year you sign up or contribute to your account. You are then required to pay taxes on that money when you withdraw it down the road. This is typically referred to as tax-deferred earnings.

Roth IRAs work a little differently. The money is considered “after-tax dollars” which means you have already paid taxes on the money you are putting into your Roth IRA via taxes paid on your paycheck. This means any gains on this account are tax-free if you have followed all guidelines set by the IRS.

Another benefit of a Roth IRA is that you are able to withdraw money if you find yourself in an emergency. You are allowed to withdraw the money you have contributed, not money gained from the investment. The withdrawal will also be tax and penalty-free. It is important to note that you cannot receive tax savings if you contribute to a 401k. That doesn’t mean that a Roth IRA couldn’t be helpful in having extra savings for retirement that is tax-free.

Things to Consider

There are additional things to consider when choosing which IRA is right for you. What tax bracket are you currently in? Are you eligible for tax deductions? What tax bracket do you predict you will be in when you retire? Can you feel comfortable making these contributions without touching the money until you retire? Do you contribute to a 401k?

Conclusion

IRAs are a powerful financial tool that you can use to save on your taxes, build wealth, and secure financial stability. Combined with a solid financial plan and investment strategy from a Wealth Management Advisor, you can rest assured that you are well on your way to a happy retirement and a stable future for you and your family.

If you are ready to save on your taxes, save for your future, and set up a solid investment plan, contact us at 513-932-3221, visit a conveniently located banking center near you, or have us reach out to you by submitting a request on our contact form.

Get Your Free Consultation Today

Try Our Retirement Calculators

401(k) SavingsA 401(k) can be one of your best tools for creating a secure retirement. Use this calculator to see why this is a retirement savings plan you can not afford to pass up. | Retirement PlannerA 401(k) can be one of your best tools for creating a secure retirement. Use this calculator to see why this is a retirement savings plan you can not afford to pass up. | Retirement ShortfallRunning out of your retirement savings too soon is one of the biggest risks to a comfortable retirement. Use this calculator to find a potential shortfall in your current retirement savings plan. | Roth IRAUse this calculator to compare the Roth IRA to an ordinary taxable investment. |

Roth IRA ConversionThis calculator will show the advantage, if any, of converting your IRA to a Roth. | Roth vs. TraditionalUse this calculator to determine which IRA may be right for you. | Social Security BenefitsUse this calculator to estimate your Social Security benefits. | Traditional IRAHow can contributing to a regular IRA help you in your retirement? |

Important Notice: Links to the interactive calculators and information provided below are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We can not and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. The material provided on this Website should be used for informational purposes only and in no way should be relied upon for financial advice. Also, note that such material is not updated regularly and some of the information may not, therefore, be current. Please be sure to consult your own financial advisor when making decisions regarding your financial management.