Financial Planning for Beginners: Simple Steps to Master Your Money

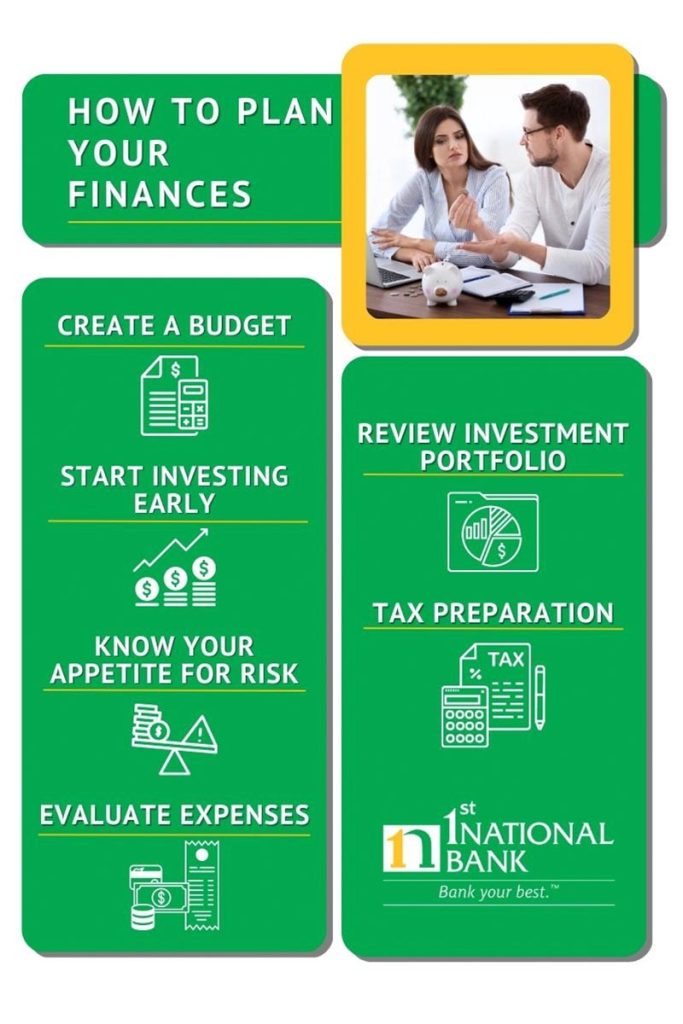

Learn how to create a budget, start investing, manage debt, and build a solid financial foundation with these easy-to-follow tips.

Are you ready to take control of your finances but unsure where to begin? Don’t worry; we’ve got you covered with straightforward tips and key aspects to consider as you embark on your financial journey. In this guide, we’ll discuss essential steps to help you plan and manage your finances effectively.

1. Establish a Budget and Stay Committed

To create a budget, first, identify your financial goals and their priorities. Analyze your income and expenses to understand your cash flow and allocate funds efficiently. We suggest reviewing your budget yearly and breaking it down monthly. Sticking to your budget ensures that you stay on track with your financial plan and objectives.

2. Begin Investing Early

Starting to invest early is crucial as it allows you to benefit from the power of compound interest, which can significantly boost your returns over time. Based on your budget, allocate a portion of your income to regular investments.

3. Determine Your Risk Tolerance

Understanding your risk appetite is essential when investing. Higher-performing investments usually involve more risk, while lower-performing investments carry less risk. Choose assets that align with your risk tolerance and invest accordingly.

4. Assess Non-Essential Expenses

Categorize your spending into essential and non-essential expenses to plan for significant purchases. Evaluate the necessity of each purchase and save money accordingly to avoid impacting your overall financial health. Also, monitor your credit balance and limit to prevent falling into debt.

5. Regularly Review Your Investment Portfolio

Maximize your investment returns by reviewing and adjusting your portfolio regularly. This allows you to reallocate funds from underperforming investments to those with higher potential returns.

6. Prepare for Taxes

Start tax planning early to avoid last-minute decision-making. Keep track of all possible tax exemptions and rebates for your investments. Consider your financial goals, standing, and portfolio performance in the context of the current economic climate.

7. Prioritize Insurance

Life and health insurance are essential, especially when working with a tight budget. Prioritizing insurance helps protect your savings from unexpected large expenses.

8. Manage Your Debt

Create a payment strategy to pay off high-interest debt as quickly as possible, allowing you to save money and invest in other wealth-building opportunities.

9. Build an Emergency Fund

Setting aside money for emergencies is crucial for financial health and planning. Aim to have a safety net for unforeseen events like medical expenses, job loss, or major repairs.

10. Factor in Inflation

When making investment and saving decisions, consider the impact of inflation. Your investments should at least keep pace with inflation, and be mindful of expense limits and minimum savings amounts.

11. Plan for Retirement

Start planning for retirement as early as possible. Allocate small amounts of money to various long-term investment options for a diversified retirement portfolio that secures your financial future.

12. Monitor Your Credit Score

Maintaining a healthy credit score is vital for securing loans during significant life events. Lenders consider your credit score when assessing the risk of lending money to you. Financing large purchases allows you to keep more funds available for investment or savings.

Conclusion

Create a checklist of financial tasks based on your goals and set reminders for recurring payments to stay on track with your budget. Budgeting and financial planning can be daunting, but by following your plan and tackling one step at a time, you can improve your financial well-being.

1st National Bank offers financial tools such as personal lending, mortgage lending, online bill payment, financial calculators, automatic savings transfers, and credit monitoring with a Secure Checking account to help you stay on top of your finances. We also offer wealth management and financial planning to assist in meeting your financial goals. Schedule a free consultation with Travis, President of 1st National Wealth Management to get started.

Important Notice: Links to the interactive calculators and information provided below are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We can not and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

The material provided on this Website should be used for informational purposes only and in no way should be relied upon for financial advice. Also, note that such material is not updated regularly and some of the information may not, therefore, be current. Please be sure to consult your own financial advisor when making decisions regarding your financial management.

Secure Checking benefits such as Credit Monitoring requires activation. Contact a banking center for more details.

Member FDIC. Equal Housing Lender.