eZBusiness | Your All-In-One Business Solution.

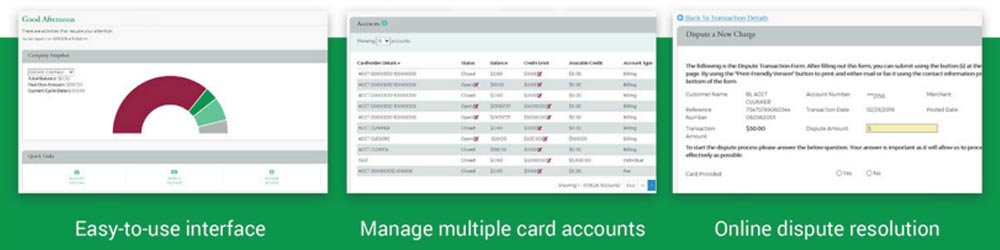

eZBusiness is a premier web-based commercial card management solution. Its industry-leading technology and integration boasts the flexibility to optimize any commercial card program. Easily manage your employees’ cards and expenses with the online business solution that grows with you.

Levels of Access

There are two levels of administrative access to choose from

|

Level 1: Basic User Access allows employees to: Manage payments Make account inquiries Update profiles And more! |

Level 2: Admin User Access allows employees to: Manage payments Make account inquiries Access reports Create/delete user profiles Update user profiles And more! |

eZBusiness Features

Real-time features include:

- Adding new cardholders

- Requesting new cards

- Requesting replacement cards

- Reallocation of existing limits in real-time

- MCC and velocity maintenance

- Closing cards

- Updating demographics

- Making payments

- Online transaction disputes and service requests

- Company alerts

- Employee online management

ePayables

ePayables is an all-inclusive business-to-business payment platform that replaces checks & other non-card payment methods. The ePayables dashboard is located within eZBusiness Card Management Tool. Because ePayables are virtual card payments, the risk of fraudulent activity is significantly lowered. ePayables are the most secure way to pay.

- Pay supplier invoices quickly and securely

- ePayable transactions are included in the annual spend total

- Reduces number of checks, ACHs, and wires

- Payment instructions are stored on a secure password-protected site

- Receive notifications when payment details are ready to be retrieved

- Send payment instructions individually or in batches using a spreadsheet

- Cancel payment anytime before supplier retrieval

- Some suppliers offer discounts for ePayables

Expense Management

Company Admins enrolled in eZBusiness Card Management can add credit card accounts to cost centers and assign GL allocations to cost centers, credit card accounts, and/or expense categories. Cardholders registered on mycardstatement.com can submit expense reports including credit card transactions, out-of-pocket expenses, and mileage expenses for admin approval. This feature also provides the ability for cardholders to attach receipts to transactions.

- Receipt imaging for attaching receipts to transactions

- Mileage/Out-of-Pocket Options allow you to reimburse cash or card purchases

- Organize your expenses through a drop-down list

- Submit expense reports to your company's admin

- Assign cardholders to cost centers that can be customized to fit your business

Visa Commercial File (VCF)

Incorporate the VCF into your business’s expense management system. VCF is a cost-effective way for your company to monitor and manage business expenses including travel claims, day-to-day equipment purchases, and allows employees to reconcile their expenses via online approval. VCF provides transaction-level data that can be pulled into a business’s expense management system for:

- Account reconciliation and management

- Automated expense reporting

- Tax monitoring

- Spending controls

- Cost management

- Preferred vendor negotiables

- Supplier management

- Regulatory reporting

Still have questions? Have us contact you.

Click here to view our Business Credit Cards, Business Services, and Business/Commercial Lending Options